Editor’s note: This blog post is guest authored by David Easthope, Senior Analyst, Coalition Greenwich, and represents insights based on the Coalition Greenwich’s research and data.

Disclosure: This Coalition Greenwich content is sponsored by Google Cloud.

Quantitative managers are increasingly relying on access to high performance computing (HPC) resources to develop their investment strategies. While buy-side firms predominantly used on-premise infrastructure in the past, both quants and risk professionals can benefit from the computational power of the cloud.

- aside_block

- [StructValue([(u’title’, u’What is HPC?’), (u’body’, <wagtail.wagtailcore.rich_text.RichText object at 0x3e8da33cbd10>), (u’btn_text’, u’Learn more’), (u’href’, u’https://cloud.google.com/solutions/hpc’), (u’image’, None)])]

On the buy side, the line between fundamental and quantitative investing is blurring as fundamental investors adopt approaches and tools long employed by quantitative investors or ‘quants.’ Quantitative research tools are creating new opportunities not only for sophisticated hedge funds with teams of data scientists, but also more traditional asset managers. For example, fundamental managers are using machine learning to analyze earnings statements and predict price movements.

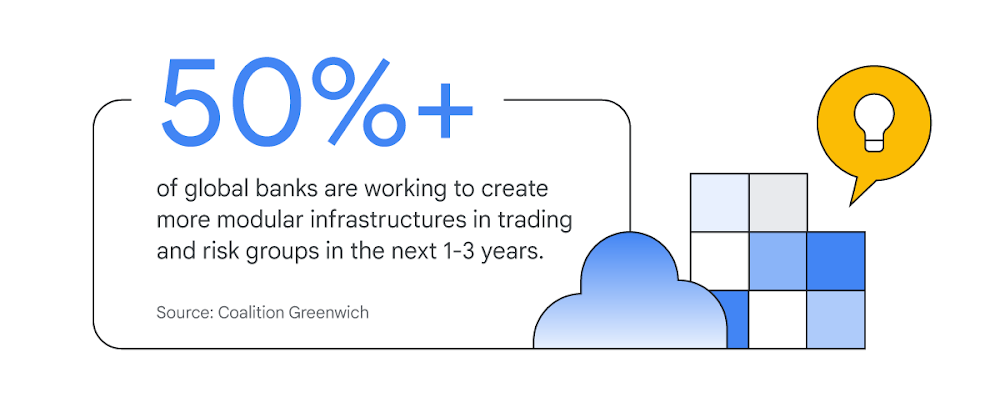

For banks, regulatory compliance and operational efficiency improvements are top priorities for trading and risk technology groups. Cloud computing is seen as a key element for increasing agility and efficiency across banks by offering scalable computational resources as well as the opportunity to leverage machine learning (ML).

Supporting quant research and risk through computational resources

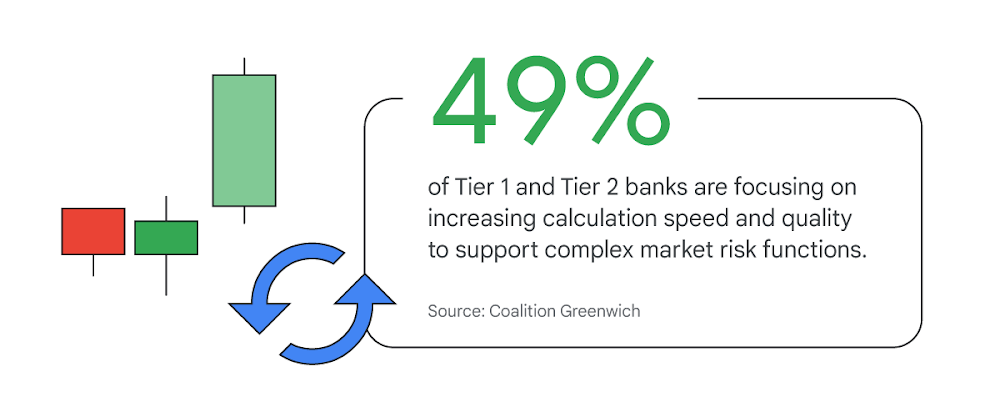

To be truly better at risk, banks need faster end-of-day risk calculations built atop resilient risk infrastructures. Better and faster data for liquidity risk, for example, can enable Tier 1 banks to measure market risk in a much more granular way to support bank capital and liquidity requirements.

One of the most universal tools for measuring market risk is value-at-risk (VaR). Banks are seeking supplementary and enhanced technologies in their trading and risk infrastructure to support these improvements, including HPC, which can power these end-of-day calculations (and even intraday calculations) for VaR.

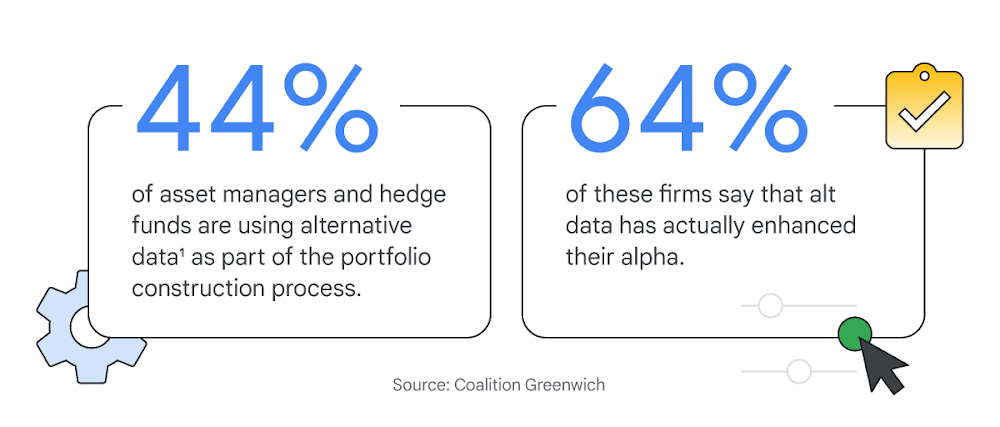

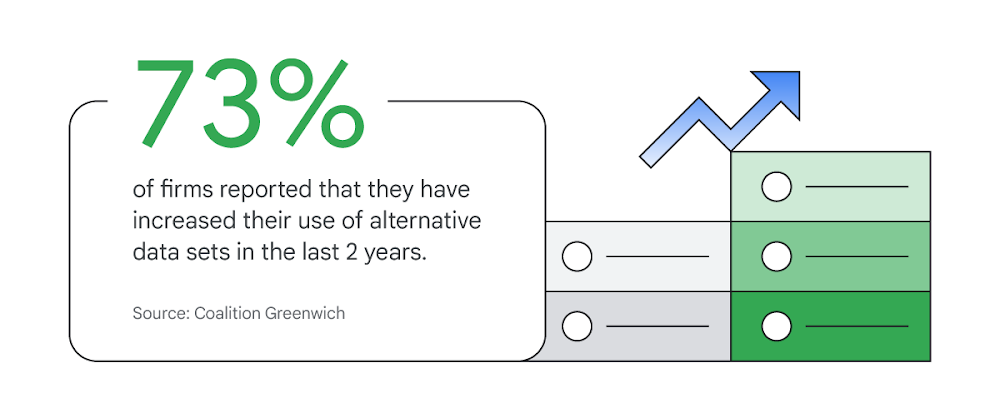

On the buy side, differentiated investment strategies require new information sources and new ways to process that information.

And the number of data sets deployed is accelerating.

As a result of the increase in alternative data sources and ‘quantamental strategies,’ managers increasingly rely on accessing HPC, including reliable and scalable storage, computational resources, and ML to handle analyst workloads. However, there are significant challenges to building scalable resources internally to support quants and their workflows.

For instance, building a dedicated server farm takes considerable time and money, and may also limit speed to market for new investment strategies. While some traditional managers may find a slow and steady approach acceptable, quantitative managers and their hedge fund brethren favor speed and flexibility, often over cost.

How do these firms make sure the demands of computational resources don’t eat into the bulk of returns? For quantitative research and strategies, this means managers are increasingly looking for ways to remain nimble and flexible. Spending millions on hardware, and then waiting months to get set up, is not a viable solution.

Cloud allows for risk managers and quants to stay nimble

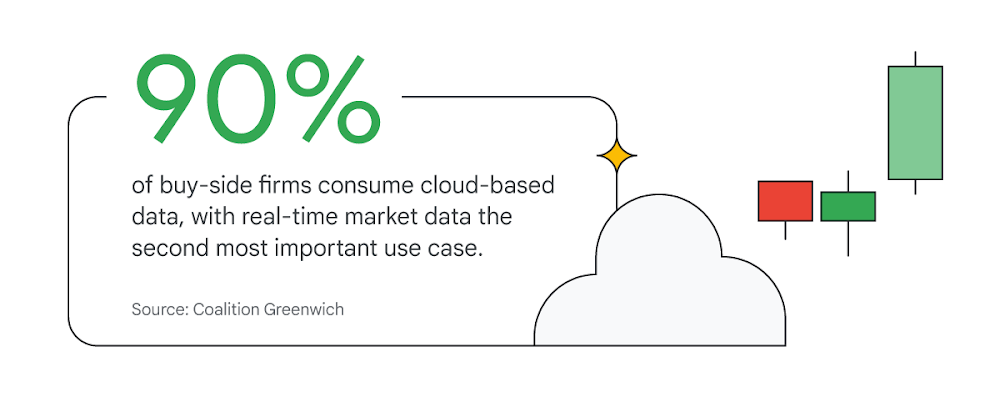

The cloud can offer the scalable infrastructure to support these computing requirements. Neither banks nor the buy side are strangers to the cloud.

Our research also shows that banks are moving away from private clouds to multi-cloud and hybrid cloud approaches.

HPC in the cloud supports risk managers and quants by allowing them to spin up workloads when necessary and pay for compute on-demand, with high-performance infrastructure that does not sacrifice performance or security. For instance, hedge fund Dark Forest claims that it can double the size of its simulation runs almost immediately on Google Cloud, as opposed to waiting months for new hardware.

- aside_block

- [StructValue([(u’title’, u’CASE STUDIES’), (u’body’, <wagtail.wagtailcore.rich_text.RichText object at 0x3e8d90d39650>), (u’btn_text’, u”), (u’href’, u”), (u’image’, None)])]

Conclusions

The need for better and faster risk infrastructure is pushing banks to adopt new computational resources. Moreover, quantamental strategies have gone mainstream and new data sources have expanded. Quants and risk managers can benefit from the computational platforms and embedded ML capabilities the cloud can offer. Risk managers will have a better view of liquidity and market risk, and investors can continue to evolve their investment strategies and stay one step ahead of the competition.

1. Examples of alternative or ‘alt data’ include web and search trends, supply chain data, social media sentiment, footfall and geolocation, satellite imagery, and weather data.

- aside_block

- [StructValue([(u’title’, u’High Performance Compute (HPC) for Value-at-Risk’), (u’body’, <wagtail.wagtailcore.rich_text.RichText object at 0x3e8d90dffb10>), (u’btn_text’, u’Read more’), (u’href’, u’https://services.google.com/fh/files/misc/google_cloud_hpc_for_risk_simulation_one_pager.pdf’), (u’image’, None)])]