Editor’s note: Apex FinTech Solutions Inc. (“Apex”) enables modern investing and wealth management tools through an ecosystem of frictionless platforms, APIs, and services. As part of its clearing and custody services (provided through Apex Clearing Corporation, a wholly owned subsidiary of Apex Fintech Solutions Inc.), Apex wanted to deliver its fintech clients in the trading and investment sector with more timely and accurate margin calculations. To transform this traditionally on-premises process, the company migrated to AlloyDB for PostgreSQL to enable real-time decision-making and risk management for clients and investors.

We know that time is money — especially for investors. In the trading and investment sector, fintech companies are leading the charge as investors demand faster, more secure, and more intuitive experiences.

Developing solutions for increasingly tech-savvy clients, however, can take a toll on computing resources. That’s why companies turn to us, Apex FinTech Solutions. Our modular ecosystem of APIs and platforms includes trading solutions that provide the routing for execution exchanges and market makers. To ensure top-notch speed and performance for our margin calculation workloads, we chose AlloyDB for PostgreSQL as our database.

Overhauling processes to invest in our success

Recently, Apex leadership has been focused on transforming on-premises processes into SaaS-based product offerings. We saw an opportunity for improvement in our margin calculation method — a crucial service for brokerages. Margin is the capital that an investor borrows from a broker to purchase an investment and represents the difference between the investment’s value and the amount borrowed. Investors should continually monitor and understand margin requirements as they are required to maintain sufficient equity to hold open positions. The amount of required equity fluctuates based upon portfolio mix and optimization, price movements, and underlying market volatility. It is also important to understand that trading firms have a fixed amount of capital they can allocate to their specific margin obligations at any given time, which may affect the requirements and equity needed to maintain their open positions.

In our previous system, we used a Java application with Microsoft SQL Server as its backend to calculate margins as a batch process that provided the start-of-day buying power numbers to our clients and investors. We ran the process in our data center via a database export file, which we chunked up and distributed across several worker nodes to calculate the margins in mini-batches.

As part of Apex’s digital transformation and cloud migration, we needed real-time data from APIs to calculate the margin on demand and help our customers to determine their risk in seconds. We knew this capability would provide a strategic advantage for Apex and our customers.

AlloyDB — a convincing solution

AlloyDB is a fully managed, PostgreSQL-compatible database solution that provides openness and scalability. As a highly regulated financial institution, total system availability and performance were critical considerations. We quickly adopted AlloyDB with confidence since it was compatible with our high availability (HA) and disaster recovery (DR) requirements right out of the box.

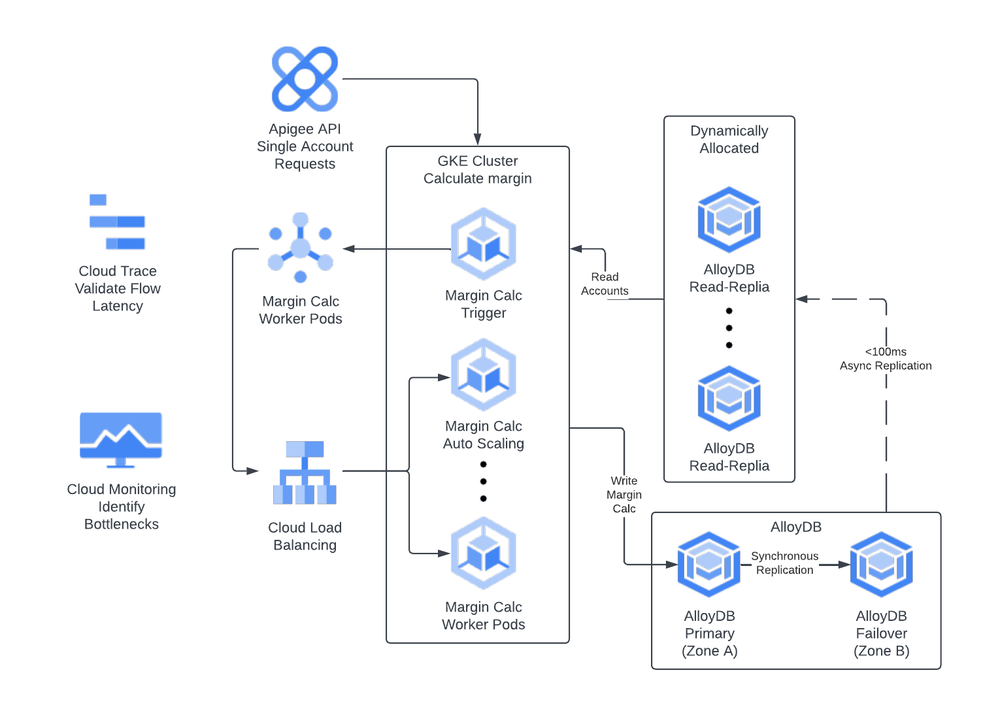

Today, a combination of a new microservices architecture and AlloyDB allows us to query directly against the real-time account data stored in the database. The functionality we use includes AlloyDB read replicas, the Google Kubernetes Engine (GKE) cluster autoscaler, a Pub/Sub event bus, and the AlloyDB columnar engine. The most crucial part of the architecture is its ability to separate write and read operations between the AlloyDB primary instance and AlloyDB read replicas. This capability provides the flexibility to segregate transactional and analytical queries, improving performance and scalability.

Since AlloyDB uses a disaggregated, shared storage system to store data, we can spin up read replicas on demand without waiting for data to be copied over from the primary instance. When the workload is complete, we can scale down replicas to minimize costs.

Moreover, we enabled the AlloyDB columnar engine since margin calculations are an analytical query from the database’s point of view. The columnar engine reduced the total CPU load on the database, saving costs by minimizing the required number of read replicas. A GKE cluster configured for autoscaling based on the number of messages in a Pub/Sub queue allows resources to scale up dynamically — so we can quickly process the entire workload more efficiently and in parallel — and then spin back down once processing is complete.

Figure 1: Architecture diagram of modern margin calculation in Google Cloud

Crunching the numbers: 50% reduction in processing time

This new, flexible architecture offers Apex customers the choice between on-demand single account margin calculations via an Apigee API or comprehensive nightly batch jobs for all accounts. This in turn gives us an opportunity to expand our existing service offerings and increase customer value.

The AlloyDB-based solution achieved a remarkable 50 percent reduction in processing time, enabling margin calculations for 100,000 accounts in just one minute.1 This is a significant improvement in efficiency and scalability. With the flexibility and speed of AlloyDB, we have significant potential to improve these results with further tuning.

We are excited to collaborate with Google Cloud to use AlloyDB in our scalable architecture for batch and real-time margin calculation without the need to move or copy data. We are now exploring the potential to migrate additional traditional PostgreSQL instances and continue driving disruption and innovation for Apex — and the future of financial services.

Get started

- Learn more about AlloyDB for PostgreSQL and start a free trial today!

1. 50% reduction in processing time is based on internal testing and benchmarking conducted in

November 2024 using the Google database and services.

All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Apex Fintech Solutions is a fintech powerhouse enabling seamless access, frictionless investing, and investor education for all. Apex’s omni-suite of scalable solutions fuel innovation and evolution for hundreds of today’s market leaders, challengers, change makers, and visionaries. The Company’s digital ecosystem creates an environment where clients with the biggest ideas are empowered to change the world. Apex works to ensure their partners succeed on the frontlines of the industry via bespoke solutions through its Apex Clearing™, Apex Advisor Solutions™, Apex Silver™, and Apex CODA Markets™ brands.

Apex Clearing Corporation, a wholly-owned subsidiary of Apex Fintech Solutions Inc., is an SEC registered broker dealer, a member of FINRA and SIPC, and is licensed in 53 states and territories. Securities products and services referenced herein are provided by Apex Clearing Corporation. FINRA BrokerCheck reports for Apex Clearing Corporation are available at: http://www.finra.org/brokercheck

Nothing herein shall be construed as a recommendation to buy or sell any security. While we have made every attempt to ensure that the information contained in this document has been obtained from reliable sources, Apex is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this document is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained due to the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Apex be liable to you or anyone else for any decision made or taken in reliance on the information in this document or for any consequential, special or similar damages, even if advised of the possibility of such damages. Dissemination of this information is prohibited without Apex’s written permission.