In today’s world where instant responses and seamless experiences are the norm, industries like mortgage servicing face tough challenges. When navigating a maze of regulations, piles of financial documents, and the high stakes of homeownership, consumers quickly find that even simple questions can turn into complicated issues. And the same can be true for the customer reps trying to help them navigate all that complexity.

Like many enterprises, Mr. Cooper is exploring how agentic AI and advanced AI agents can help both our customers and employees meet their needs with confidence. In our work to develop just such an agent with Google Cloud, one of our curious discoveries has been that like a good team, the best AI agents may just be made up of groups of agents with distinct skillsets and abilities, and we come to the best results when they’re working in concert.

At Mr. Cooper, our mission is to “Keep the dream of homeownership alive.”We’re here to simplify the journey, provide clarity, and ensure our customers feel confident every step of the way. That confidence is key when they’re making one of the most consequential purchases, and decisions, of their lives.

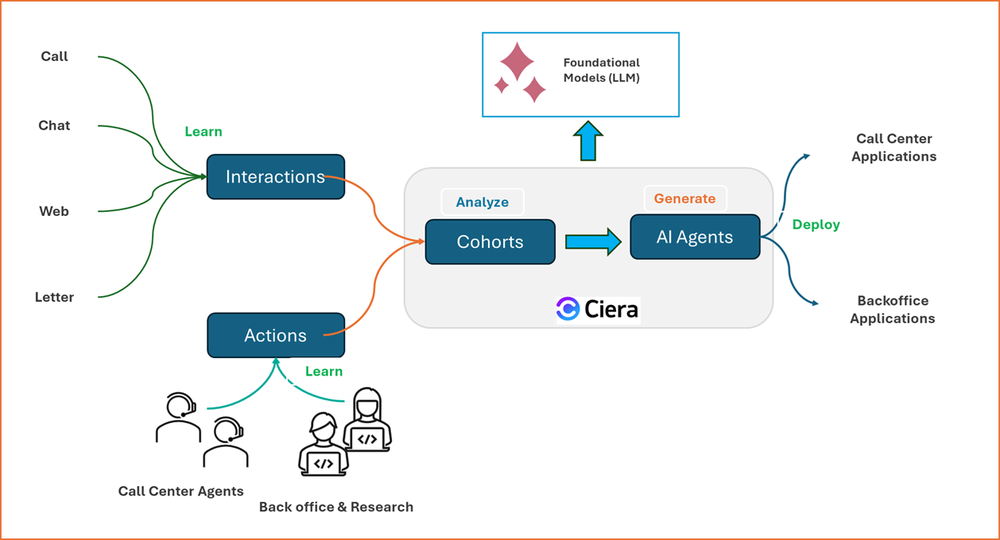

With those dual goals of simplicity and certainty in mind, we partnered with Google Cloud to develop an agentic AI framework designed to complement and support our team. We call it the Coaching Intelligent Education & Resource Agent, or CIERA. We asked ourselves how to implement a chatbot that could effectively collaborate with our human agents to streamline both sides of the customer service experience.

And just as we prioritize hiring great groups of customer reps and mortgage agents, we’ve discovered how important it is to put together the right group of agents to effectively meet the needs of all our users. CIERA is designed to do exactly that, handling routine and time-consuming tasks to enhance efficiency, while empowering our people to focus on delivering what they do best — empathy, judgment and meaningful human connection.

CIERA represent an exciting step forward in blending human expertise with AI capabilities, creating a collaborative approach that elevates both the customer experience and our team’s impact. And just as important as this work is for Mr. Cooper, CIERA also demonstrates how our multi-agent approach can serve as a model for companies across industries. Read on to learn how we did it, and how you can, too.

The challenge: Beyond the reach of traditional automation

Mortgage servicing is uniquely complex, where a customer might have a single question that requires an agent to cross-reference multiple documents.

This presents several challenges for traditional automation:

-

Siloed Knowledge: Scattered information makes it hard to see the full picture, but AI surfaces key data, helping agents make faster, smarter decisions for customers.

-

Lack of Understanding: Traditional systems rely on rigid keywords and decision trees, often missing the true intent behind customer inquiries. Our AI framework uncovers context and intent, equipping agents with the insights they need to respond with empathy and accuracy.

-

Inflexible Processes: When conversations take unexpected turns, legacy automation often fails, creating dead ends for customers and the team. AI provides real-time adaptive guidance, helping agents navigate these twists seamlessly.

To truly elevate the customer experience, we needed a solution capable of reasoning, orchestrating, and understanding context — one that enhances and amplifies our capabilities to deliver exceptional service.

The vision: Introducing CIERA, a collaborative AI agent workforce

Our vision was to create an agentic framework that supports our call center agents by leveraging Google Cloud’s Vertex AI platform. CIERA’s AI agents handle repetitive and complex tasks, allowing our team to focus on what technology can’t.

Guided by the principle that AI enhances human performance, these digital collaborators are designed to deliver accurate, comprehensive, and human-centered solutions.

Building the agent workforce: Our architectural blueprint

Our modular architecture assigns distinct roles to each AI agent, creating a scalable, efficient. and manageable system that seamlessly collaborates with people to make work smoother and more rewarding.

Meet the key players of our digital team and the solutions they deliver for team members and customers:

-

Sage, the Head Agent: Sage monitors how all other AI agents perform. By learning from patterns across workflows, Sage helps ensure that each AI agent works in harmony with human teams. Key abilities include intelligent agent monitoring, recognizing useful trends and fine-tuning orchestration.

-

Ava, the Orchestrator: Ava serves as the team’s coordinator, managing complex customer inquiries by breaking them into manageable tasks and assigning them to the appropriate AI assistants. While Ava doesn’t interact directly with customers, it ensures processes run smoothly, empowering human agents to remain central to delivering solutions.

- Lex, the Task Specialist: Lex specializes in complex tasks, helping human agents during customer calls by quickly offering insights to questions around loan applications or escrow analyses. Working behind the scenes, Lex provides insights that allow people to focus on connecting with customers and making informed decisions.

- Sky, the Data Specialist: Sky helps human teams navigate internal knowledge bases and FAQs. For questions about policies, procedures, or definitions, Sky provides accurate and timely information, freeing people to spend more time on meaningful interactions, rather than searching for data.

-

Remy, the Memory Agent: Remy assists by remembering past actions and outcomes, which helps personalize workflows and inform future decisions. Remy’s memory supports ongoing learning and training, making it easier for human agents to access shared knowledge and continuously improve their skills.

-

Iris, the Evaluation Agent: By evaluating confidence scores, detecting hallucinations, and grounding responses with Model Armor, Iris ensures consistency and authenticity, helping human agents provide trustworthy customer support.

A sample analysis performed by CIERA.

How it works in practice: A real-life scenario

Imagine a customer initiates a call asking, “I received a notice my escrow payment is increasing. Can you explain why and tell me what my new total payment will be?”

Instead of relying solely on automated responses, CIERA ensures every step is grounded in close partnership between AI agents and human team members:

- Orchestration: Ava receives the query, understands the two distinct parts (the “why” and the “what”), and creates a plan. Ava consults with a human agent, confirms the correct context and then delegates tasks to the Lex agents.

- Parallel Processing: With human oversight, Ava assigns the “why” task to Lex, pointing it to the customer’s most recent escrow analysis document. Simultaneously, it tasks another Lex agent to calculate the new total payment based on data from our systems.

- Synthesis: The Lex agent reads the document and reports back to the human agent: “The increase is due to a $200 annual rise in property taxes.” The other agent confirms the new total payment. The human similarly reviews the payment calculation before moving ahead.

- Resolution: Ava gathers all AI-generated insights, but the human agent validates and personalizes the final response as needed to ensure clarity, empathy, and accuracy before delivering it to the customer.

This human-in-the-loop approach ensures complex, multifaceted questions are resolved with both the efficiency of advanced AI and understanding nuances with the trust that only people can provide. The partnership guarantees every answer is not just quick, but also trustworthy and tailored to the customer’s needs.

Ensuring quality and trust: The “agentic pulse” and human oversight

In a regulated industry like ours, trust and accuracy are non-negotiable. Deploying advanced AI requires an equally advanced framework for evaluation and governance. To achieve this, we developed two key concepts:

- The “Agentic Pulse” Dashboard: Our central command center for monitoring the health and performance of our agent workforce. Powered by model-based evaluation services within the Vertex AI platform , it goes beyond simple metrics. We track:

- Faithfulness: Is the agent’s answer grounded in the source documents

- Relevance: Does the answer directly address the customer’s question

- Safety: Does the agent avoid generating harmful or inappropriate content

- Business Metrics: How do we correlate these quality scores with classic KPIs like average handle time (AHT) and customer satisfaction (CSAT)

- The “Sandbox” for HITL: Our “Sandbox” environment provides space for our business and technical teams to safely review, test and refine agent processes. Additionally, if the “Agentic Pulse” flags an interaction for review, a human expert can analyze the agent’s reasoning and provide feedback, ensuring a continuous cycle of improvement and learning.

This robust governance framework gives us the confidence to deploy these powerful tools responsibly.

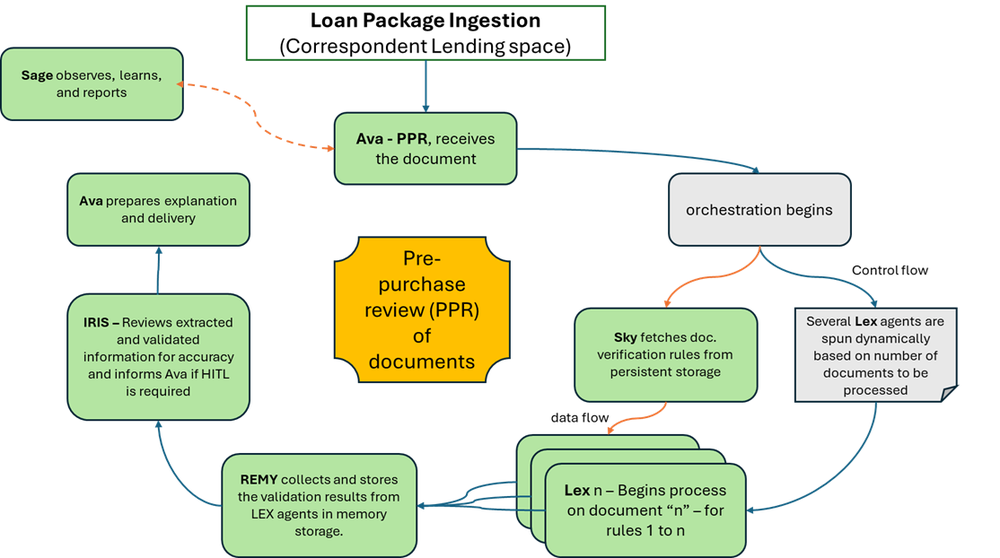

Example of a theoretical loan analysis assisted by CIERA.

Projected impact: From complex processes to clear wins

While CIERA is on its journey towards full production, our projections based on extensive testing and modelling point to historic and transformative gains across the board:

-

For our customers: We project a reduction in wait times and a higher rate of first-contact resolution, so customers can get answers quicker and with the benefits of round-the-clock support for many complex scenarios.

-

For our human agents: By automating tedious research, CIERA will free up our human agents to focus on sensitive and complex customer relationships that require a human touch and create better tools and resources for more engaging work.

-

For our business: We anticipate a major reduction in average handling times for a large segment of inquiries and faster, more accurate resolutions that are a direct driver of customer happiness and loyalty.

Beyond mortgages: A blueprint for any complex industry

The architectural patterns developed with CIERA are not limited to mortgage servicing. This agentic approach — of using an orchestrator to manage a team of specialized AI agents—is a powerful blueprint that can be applied to any industry, including healthcare, logistics and manufacturing, by grappling with information and task complexity.

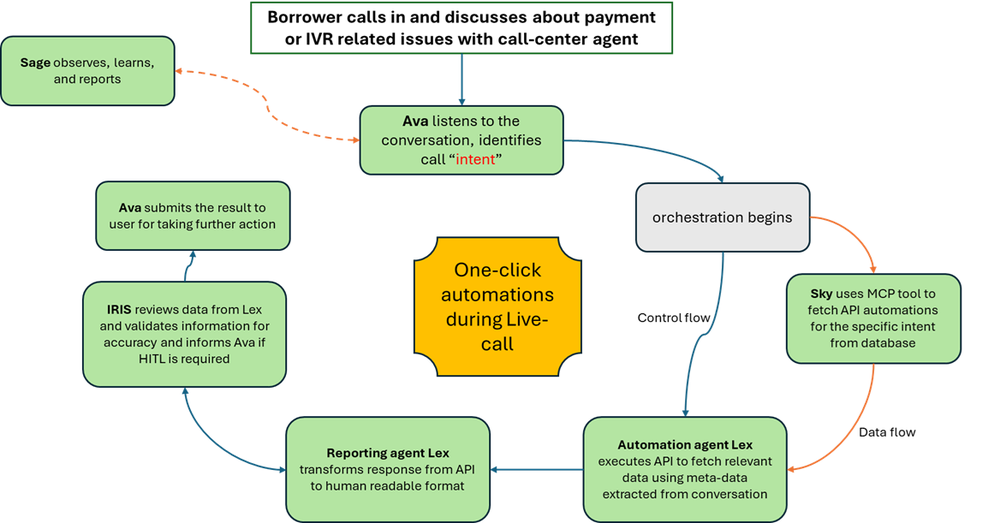

A typical workflow with CIERA.

The future is agentic and collaborative

Our journey with CIERA is just beginning, but it has already solidified our belief that the future of customer service is agentic driven. By combining Mr. Cooper’s deep industry expertise with Google Cloud’s world-class AI infrastructure, we are not just building bots, we are cultivating a digital workforce.

This collaboration is about more than just lowering costs or improving efficiency — it’s about building trust, delivering clarity, and creating a customer experience truly worthy of the dream of homeownership.

The team would like to thank Googlers Sumit Agrawal and Crispin Velez and the GSD AI Incubation team for their support and technical leadership on agents and agent frameworks as well as their deep expertise in ADK, MCP, and large language model evaluations.