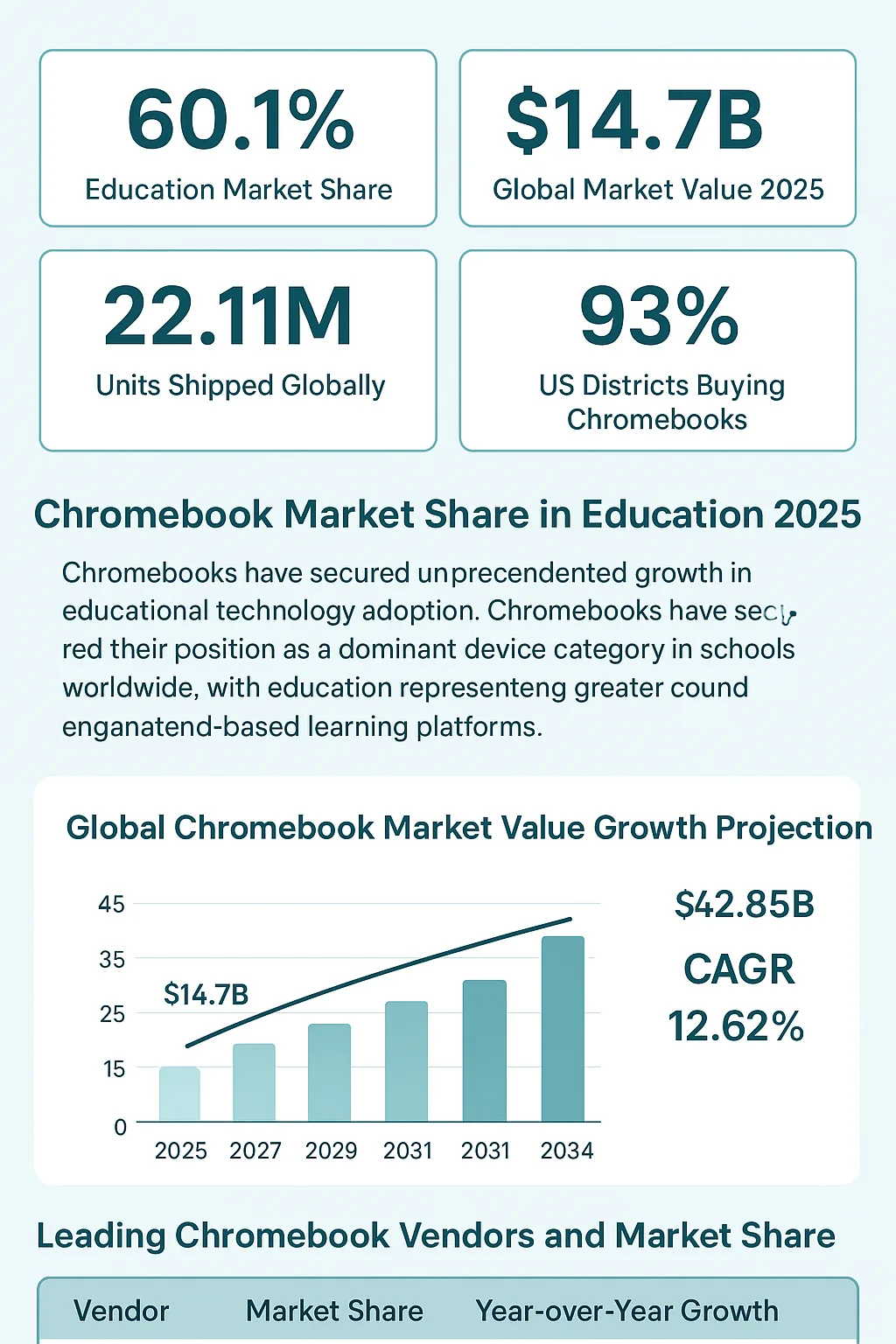

Chromebook Market Share in Education 2025

The chromebook stats reveal unprecedented growth in educational technology adoption. Chromebooks have secured their position as the dominant device category in schools worldwide, with education representing 60.1% of the global chromebook market share. This surge reflects the strategic shift toward cloud-based learning platforms and cost-effective digital infrastructure in educational institutions.

Global Chromebook Market Value Growth Projection

The global chromebook market reached $14.7 billion in 2025, demonstrating robust expansion from previous years. Market analysts project this figure will grow to $42.85 billion by 2034, representing a compound annual growth rate of 12.62%. This growth trajectory underscores the increasing adoption of cloud-first computing solutions across educational and enterprise sectors.

Leading Chromebook Vendors and Market Share

The chromebook vendor landscape shows dynamic competition among established technology companies. In the first half of 2025, vendor performance demonstrated clear market leaders and emerging growth patterns that shape the competitive environment.

Chromebook Vendor Market Share H1 2025

| Vendor | Units Shipped (H1 2025) | Market Share | Year-over-Year Growth |

|---|---|---|---|

| Lenovo | 3.5 million | 25.3% | +27% |

| HP | 1.67 million | 21.5% | +12% |

| Acer | 2.2 million | 16.8% | +10% |

| Dell | 1.5 million | 13.2% | -5% |

| ASUS | 0.8 million | 8.4% | +43% |

Lenovo emerged as the market leader with 3.5 million units shipped in the first half of 2025, marking impressive 27% year-over-year growth. This dominance was largely bolstered by its strong role in Japan’s GIGA School Program and strategic partnerships with educational institutions globally. HP maintained its strong position with 1.67 million units and steady 12% growth, while ASUS showed remarkable momentum with 43% growth despite smaller overall volume.

Chrome OS Market Penetration in Schools

Chrome OS continues to expand its presence in educational computing environments. The operating system now holds approximately 1.86% of the global desktop market share, though this figure increases significantly in educational contexts. In the United States, Chrome OS commands a stronger 8.44% desktop market share, reflecting concentrated adoption in educational institutions where Chrome usage patterns demonstrate sustained engagement with Google’s ecosystem.

Chrome OS Market Share by Context

Regional Chromebook Adoption Patterns

Regional adoption varies significantly, reflecting different educational policies, economic conditions, and technological infrastructure capabilities. North America maintains its position as the largest chromebook market, while Asia-Pacific demonstrates the fastest growth trajectory.

Regional Market Distribution and Growth Projections

| Region | Market Share 2025 | Projected CAGR (2025-2030) | Key Growth Drivers |

|---|---|---|---|

| North America | 52.4% | 3.2% | K-12 educational demand, 93% of US districts purchasing |

| Asia-Pacific | 28.1% | 4.7% | Digital education funding, government initiatives |

| Europe | 13.5% | 2.9% | Educational technology integration, government support |

| Latin America & Others | 6.0% | 3.8% | Emerging market penetration, affordability focus |

North America leads with 52.4% of global market share, primarily driven by US K-12 educational demand. In 2025, 93% of US districts intend to purchase Chromebooks, up from 84% in 2023, with 68% now drawing funds from local or state revenues rather than federal allocations. This shift indicates sustainable, institutionalized adoption rather than temporary pandemic-driven purchasing.

Chromebook Product Categories and Form Factors

The chromebook market encompasses various form factors designed to meet diverse educational and professional needs. Traditional laptops continue to dominate, though tablets and convertible devices show promising growth trajectories.

Product Type Market Share Distribution 2025

| Product Type | Market Share 2025 | Projected CAGR (2025-2030) | Primary Use Cases |

|---|---|---|---|

| Traditional Laptops | 63.4% | 3.1% | General computing, typing-intensive tasks |

| Tablets | 21.8% | 9.6% | Interactive learning, touch-based applications |

| Convertibles/2-in-1 | 14.8% | 6.4% | Hybrid workflows, presentation modes |

Traditional laptops maintain dominance with 63.4% market share due to their balance of performance and cost-effectiveness. However, tablets represent the fastest-growing segment with 9.6% CAGR, driven by touch-optimized curricula and interactive learning applications. The growth in tablet adoption reflects educational institutions’ increasing focus on Chrome extension capabilities and touch-enabled learning experiences.

Processor Architecture Evolution

The processor landscape in educational chromebooks is shifting toward ARM-based solutions, driven by cost advantages and energy efficiency improvements. This architectural transition impacts performance capabilities and battery life across different device categories.

| Architecture | Market Share 2025 | Projected CAGR (2025-2030) | Key Benefits |

|---|---|---|---|

| x86 (Intel/AMD) | 71.6% | 2.8% | Performance, application compatibility |

| ARM | 28.4% | 8.7% | Energy efficiency, cost optimization, AI capabilities |

Distribution Channels and Procurement Trends

Educational institutions increasingly favor online retail channels for chromebook procurement, reflecting the shift toward digital-first purchasing processes and bulk ordering capabilities.

Online retail dominates with 55.6% market share and 5.9% CAGR, demonstrating schools’ preference for streamlined bulk purchasing processes. Institutional contracts remain significant at 38.2% share, particularly for large district deployments requiring custom configurations. The trend toward online procurement aligns with Chrome permissions management needs and simplified device administration.

Distribution Channel Market Share 2025

Emerging Technologies and Innovation Trends

Chromebook innovation in 2025 focuses on artificial intelligence integration, enhanced connectivity options, and sustainable device management strategies that address educational institutions’ evolving technology requirements.

| Innovation | Impact on Education | Adoption Timeline |

|---|---|---|

| Chromebook Plus with AI | Enhanced productivity, AI-powered writing assistance | Currently available |

| Class Tools Integration | Teacher classroom management, content sharing | Widespread deployment |

| 5G/LTE Connectivity | Extended internet access for remote learning | Expanding availability |

| Sustainable Refresh Programs | Cost-effective upgrade cycles, reduced e-waste | Implementation phase |

Class Tools enable teachers to share content, restrict tabs, and monitor student screens effectively. Chromebook Plus models provide enhanced AI features and better performance for classroom multitasking scenarios. LTE-enabled chromebooks expand access for students without reliable home internet connectivity, addressing digital equity concerns in education.

Enterprise Adoption Growth

While education remains the dominant sector, enterprise adoption shows the fastest growth at 8.2% CAGR as businesses embrace cloud-based computing solutions. This growth reflects changing workplace requirements and the increasing acceptance of chromebooks for professional applications where AI tools integration becomes essential.

Market Challenges and Opportunities

The chromebook market faces several challenges including internet dependency, application limitations, and competitive pressure from traditional laptop manufacturers. However, opportunities exist in emerging markets, enterprise segments, and specialized educational applications.

Device programs are transitioning from emergency procurement to sustainable refresh planning strategies. Schools now implement rolling refresh cycles to manage costs while maintaining current technology standards. This approach reduces both financial burden and environmental impact compared to simultaneous fleet replacements.

Competition with Windows laptops and iPads continues to influence pricing and feature development. Chromebook manufacturers respond by enhancing processing power, display quality, and software capabilities while maintaining cost advantages. The integration with Google Workspace and Gmail usage patterns strengthens the ecosystem appeal for educational institutions.

Frequently Asked Questions About Chromebook Statistics

What percentage of schools use chromebooks in 2025?

In 2025, 93% of US school districts intend to purchase chromebooks, representing a significant increase from 84% in 2023. Globally, chromebooks hold 60.1% of the education market share, making them the dominant device category in schools worldwide.

Which chromebook vendor leads the market in 2025?

Lenovo leads the chromebook market with 3.5 million units shipped in the first half of 2025, capturing 25.3% market share with 27% year-over-year growth. HP follows with 21.5% market share, while Acer holds 16.8% of the market.

How large is the global chromebook market in 2025?

The global chromebook market is valued at $14.7 billion in 2025, with 22.11 million units shipped worldwide. The market is projected to reach $42.85 billion by 2034, growing at a compound annual growth rate of 12.62%.

What is Chrome OS market share on desktop computers?

Chrome OS holds approximately 1.86% of the global desktop operating system market share. However, in the United States, Chrome OS commands a stronger 8.44% market share, significantly higher than the global average due to concentrated educational adoption.

Which regions show the fastest chromebook growth?

Asia-Pacific represents the fastest-growing region for chromebooks with a 4.7% CAGR through 2030, driven by digital education funding initiatives and government-led digitalization programs. North America maintains the largest market share at 52.4%.

What chromebook form factors are most popular in schools?

Traditional laptops dominate with 63.4% market share in educational settings. However, tablets show the fastest growth at 9.6% CAGR, while convertible 2-in-1 devices hold 14.8% market share with 6.4% growth rate.

How do schools typically purchase chromebooks?

Online retail channels dominate chromebook procurement with 55.6% market share and 5.9% CAGR growth. Institutional contracts account for 38.2% of purchases, while offline retail represents only 6.2% of the market.

Sources and References

- Mordor Intelligence. (2025). “Chromebook Market Size, Trends, Share Analysis & Research Report, 2030.” https://www.mordorintelligence.com/industry-reports/chromebook-market

- Custom Market Insights. (2025). “Global Chromebook Market Size, Trends, Share 2025-2034.” https://www.custommarketinsights.com/report/chromebook-market/

- About Chromebooks. (2025). “Chromebook Statistics 2025.” https://www.aboutchromebooks.com/chromebook-stats/

- Market Data Forecast. (2025). “Chromebook Market Size, Share, Trends & Growth Report, 2033.” https://www.marketdataforecast.com/market-reports/chromebook-market

- EdWeek Market Brief. (2025). “How School Districts’ Spending on Chromebooks and Other Devices Will Change Over the Next Year.” https://marketbrief.edweek.org/education-market/how-school-districts-spending-on-chromebooks-and-other-devices-will-change-over-the-next-year/2025/01