As the pandemic eased in 2022 and 2023, US core business centers in large and small cities continued to suffer the after effects or remote- and hybrid-work policies, which led to a 20% to 40% reduction in office space use and a devaluation of properties. The big switch to remote work left many downtowns largely empty for months.

Since then, commercial areas have seen a slow but steady return to the office, with average office occupancy rate hitting more than 60%.

Still, many offices remain partially or completely empty.

“We are approaching 20 quarters of contraction in the office market,” according to Peter Miscovich, global future of work leader at Jones Lang LaSalle IP (JLL), a commercial real estate and investment management services firm. “There are signs of stabilization of vacancies in certain parts of the country.”

One trend affecting the repopulation of corporate cubicles involves a rash of return-to-office (RTO) mandates. Last month, for example, Amazon CEO Andy Jassy told employees to get back into the office five days a week beginning in early 2025. Ericsson recently tightened its policy for office attendance, too — a decision it later decided was made too quickly.

Earlier this year, Dell Technologies ordered many workers to return to their corporate desks, and more recently told its global sales team to work in office five days a week. And just last week, 3M ordered senior employees back to corporate headquarters.

According to one recent survey, most companies are pushing for RTO mandates in 2025. The survey by ResumeBuilder found that nine in 10 companies will enact RTO mandates based on data from 764 companies that transitioned to a fully remote work model during the pandemic. But the data is nuanced. Not all RTO policies, of course, require employees to be in the office five days a week.

Kastle

“There’s only 25% of companies, overall, seeking RTO five days per week, and the remaining 75% are involved in various forms of hybrid or hybrid/remote and my forecast is that hybrid will endure,” Miscovich said.

The ResumeBuilder survey results were similar to Miscovich’s findings. The majority of companies are operating with a hybrid model, while 30% require employees to be in the office full-time.

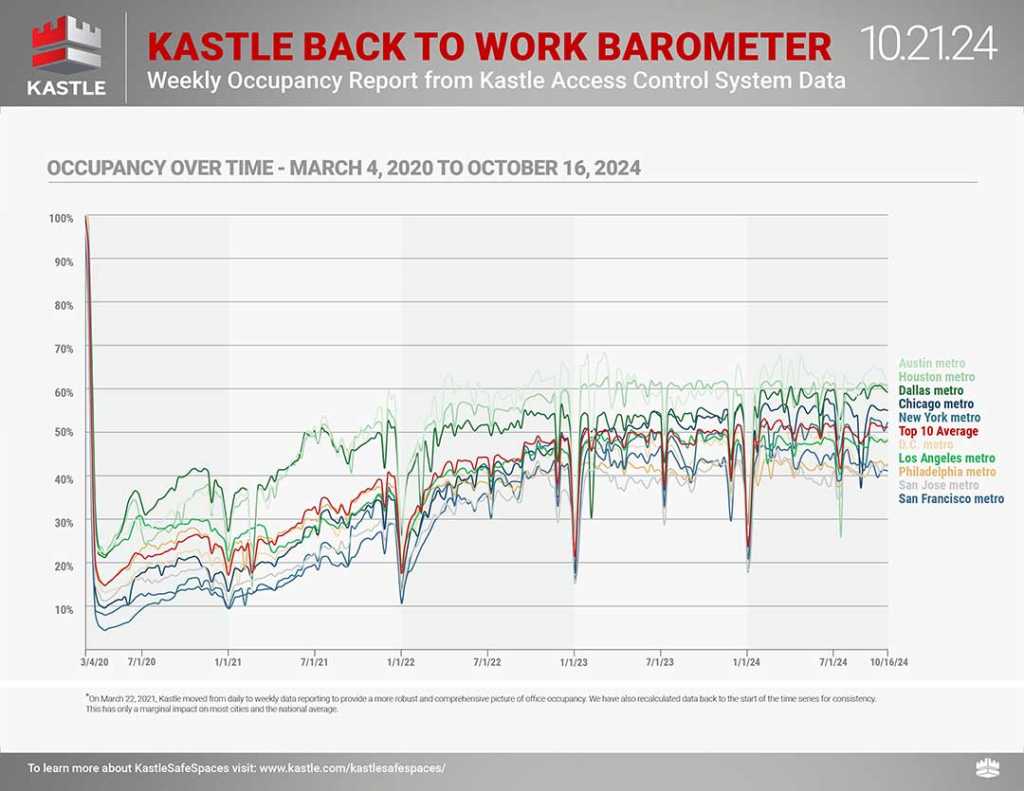

Office occupancy rates fell from 100% in February 2020, at the start of the pandemic’s stay-at-home orders, to just 14% by April of that same year. Over the next four years, those rates have slowly climbed as companies embraced hybrid work policies. But on average, occupancy never fully returned to 100%, according to Kastle Systems, a provider of security key fob technology for 2,600 buildings in 138 US cities.

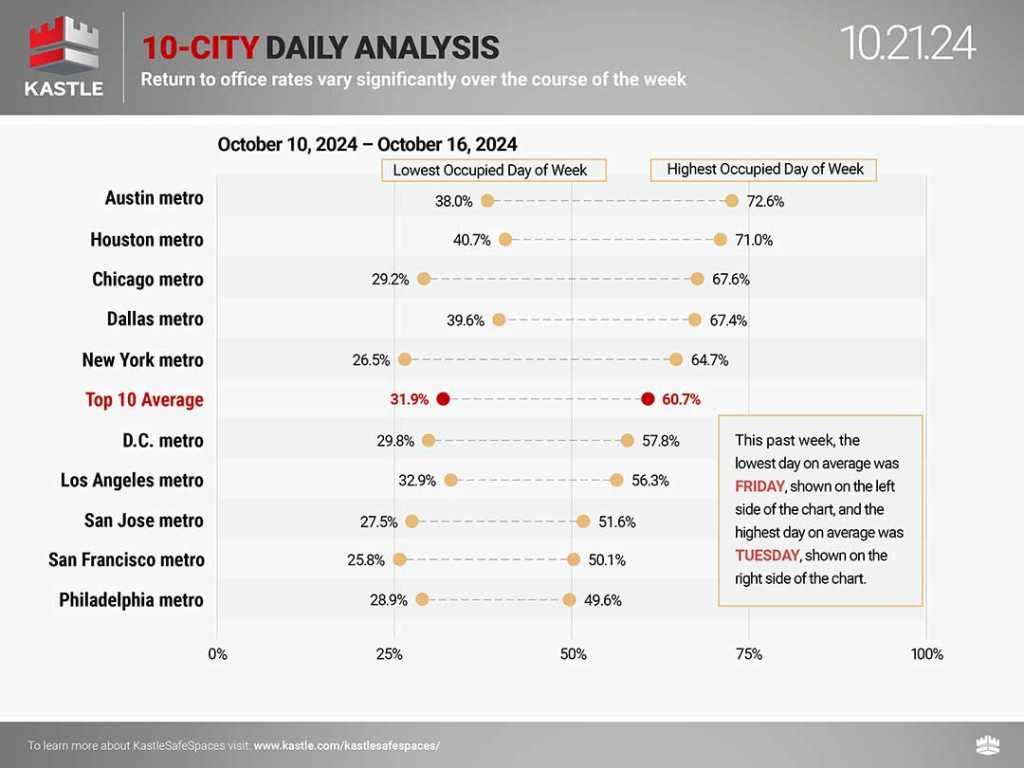

Recent data shows occupancy rates are again climbing. In January, the peak occupancy rate of US office buildings stood around 46% based on a 10-city average, according to Kastle. Today, more than 61% of buildings are occupied in those same 10 large cities. And cities such as Austin and Houston are seeing occupancy rates as high as 77% to 71%, respectively. Chicago’s office building occupancy rate stands at 69%.

Peak occupancy rates are only half the story. “Peak” relates to days when offices are most full, such as on Mondays and Tuesdays. On less popular days, such as Fridays, office occupancy rates dipped as low as 33% this month.

Kastle

Despite the rise in occupancy rates, office values remain depressed compared to before the pandemic, according to the National Bureau of Economic Research (NBER). It found there has been a 39% decline in office building values since 2020 — and a large percentage of pre-pandemic leases will come up for renewal in the next few years. That could force some companies to more closely evaluate their office needs.

The COVID pandemic served as something of an unintentional experiment that revealed a host of uncomfortable workplace truths — namely, that most employees always preferred remote work and at-home knowledge workers were just as, if not more, productive. Another realization: working in the office, by default, isn’t as rewarding some people as it is for others, according to Phil Kirschner, an associate partner in McKinsey & Co.’s real estate and people and organizational performance practices.

Not everyone, for example, feels the same level of inclusion and equality in an office setting. “Diverse populations of almost any measure — whether skin color, sexual orientation, physical disability — are affected by in-office requirements, and there’s a higher desire for workplace flexibility either when taking a job or the likelihood to leave a job if you’re not offered it,” Kirschner said in an earlier interview with Computerworld.

Higher quality buildings, such as those that are newer and have more amenities, have fared better of late. That’s prompted a rush to build or renovate older offices that not only have newer amenities and mixed-use spaces (such as combined office, shopping and recreational facilities) but updated technology to better support remote and hybrid workers.

But older properties with fewer amenities could suffer. In particular, Class B, Class C and even lower-end Class A grade buildings could see the biggest valuation declines in the current market; those who are leasing or buying space now want top-notch AAA buildings — those with the latest amenities, technologies, and locations.

“There’s a potential space shortage in certain districts and locations,” Miscovich said. “Even three-days a week in the office is affecting demand. We are seeing demand for that high-quality space, but there’s also the surplus of the obsolete, class B- or C buildings that are not serving the workforce of the future.”

Leading the return-to-office trend are legal firms, financial services organizations, defense contractors, and industrial companies seeking to expand their footprint as the result of business demands.

“And, then the technology sector is picking up in places where they have AI talent demands and key urban centers for tech talent,” Miscovich said. “Technology is fascinating because you have some firms becoming more office centric and others are still offering more of a hybrid approach. We’ll see how that sector plays out over the next couple of years.”

Miscovich describes the pandemic was “an accelerant” and “time machine” that moved the US workforce 10 years into the future in just two years. Remote work was inevitable with the evolution of the digital economy, and the pandemic showed the promise of hybrid and distributed work.

Now workplace design, leadership, culture, workplace practices, change management, hybrid workplace technologies — all need to mature as we go forward beyond the post pandemic world, he said.

“The future of work will be distributed; it will be diverse and it will be dynamic. I think the RTO mandates occurring are for individual companies in that 25% range,” Miscovich said. “That may increase to 30%, but our point of view is hybrid work will endure for the longer term. We have some clients that by 2027 or 2030 may have a portion of their workforce in office five days a week and another portion of their workforce at three days a week or three days a month.

“I don’t think there will be ever a future steady state, just given the dynamism of artificial intelligence, talent and distributed work,” he said. “I think we’ll see a continuous evolution and continuous learning mind set relative to future of work strategies.”