When our founders began Mambu in 2011, their goal was to bring the latest digital technologies to the banking and finance world. Banking, in particular, is an industry built on decades of deep legacy technology. So initially, Mambu was embraced by microfinance — 100 organizations in 26 countries in just the first two years.

Since then, acceptance of modernizing core banking services by using composable, cloud technologies has grown across financial services institutions (FSIs). We now service top-tier banks, fintech startups, and other finance organizations across six continents, helping them deliver flexible, personalized, customer-centric banking products and services that their customers can depend upon.

One of the main reasons we’ve been able to scale the Mambu composable banking platform across the globe and at our current pace is our partnership with Google Cloud. The decision to move forward with Google Cloud happened for several reasons.

1. Flexibility and openness. Many FSIs are on hybrid and multicloud technology stacks, as they may still be transitioning from legacy systems, or have data residency requirements that have led them to use different clouds in different regions. Mambu meets customers wherever they are in their cloud journeys. We support interoperability without vendor lock-in. This need for openness, as well as the scalability benefits, led Mambu to evolve our platform on Google Kubernetes Engine (GKE). Many customers use open-source Kubernetes because, this common foundation can help streamline integration, speed up time to market, and reduce development. Just as important, the Google Cloud open cloud approach matches our company values.

2. Security and data residency. For customers in highly regulated finance industries, security isn’t just top of mind, it’s the No. 1 requirement. In addition to Google Cloud’s secure infrastructure, external audit certifications, and encryption, its wide array of regions has allowed us to expand into more countries, where we serve banks that must meet local data residency requirements. For example, Google Cloud’s Jakarta Cloud Region, has allowed us to support Bank Jago in Indonesia as it brings more financial inclusion to the unbanked in that country.

3. Availability. It’s critical for banks to maintain basic financial functionality, like accepting deposits and serving cash, even amid a service disruption. We needed a cloud partner with impeccable redundancy, failover, and disaster recovery capabilities.

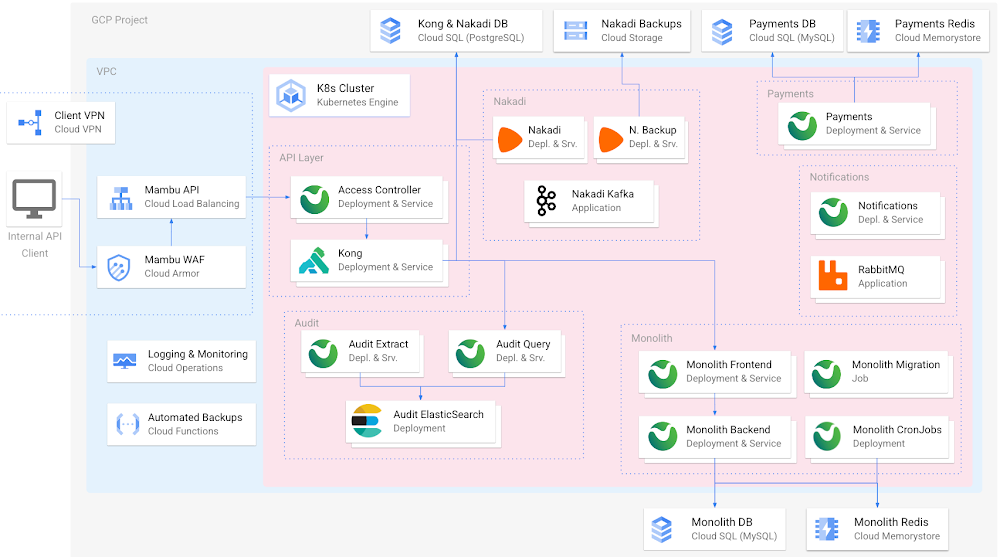

In addition to GKE, the Mambu platform uses several other Google Cloud services for specific functions, including Cloud Armor, Cloud Load Balancing, Cloud VPN, Cloud Memorystore, and Google Cloud Operations.

Another important reason we chose to partner with Google Cloud was its expansive ecosystem and commitment to innovation. We are midway into a three-year journey to modernize our own technology stack to meet customer needs.

Building a roadmap with Google Cloud

Our customers need a core banking technology platform that will grow with them as they bring to market innovative services built on the latest technology advances. For Mambu to be that platform, we need a cloud partner that supports and scales with our growth. While we originally built our cloud architecture on GKE and Compute Engine (among a few other Google Cloud services), we’re now looking to a serverless future where we can scale more easily and leverage managed services within Google Cloud and its partner ecosystem to focus on our core offerings.

These are just some of the modernization and customer-led innovations that we’re cooking up:

-

More workloads in GKE: Like many companies, our cloud transformation is a work in progress. While much of our codebase is in GKE, we’re continuing to break up some larger pieces of code into microservices to increase agility and velocity, enabling us to make consistent updates to discrete areas of our platform without affecting the whole. GKE is the leader for orchestrating microservices at scale and continues to be a natural fit.

-

Native BigQuery integration: Mambu customers collect a tremendous amount of data within the platform that can be used for analytics, personalization, and other use cases. We’re planning to create a seamless integration for feeding core banking data from Mambu into BigQuery so that customers can better leverage their valuable data.

-

CloudSQL vs. self-managed MySQL: We have almost completed migrating from our own MySQL instances to managed Cloud SQL databases, which will open up new opportunities to implement customer-centric solutions such as BigQuery integration.

-

A serverless future with Cloud Run: Compute Engine is working well for Mambu, providing the flexibility to choose the virtual machines that best balance performance and cost needs. As we seek even more time and cost efficiencies, we believe the elastic scalability of a serverless architecture built on Cloud Run will get us there, and we’re considering going serverless in the future. Doing so would abstract infrastructure for simpler management, while allowing us to fire up containers to meet our customers’ high transactions-per-second needs, spin them down when not needed, and pay only when they run. It would also boost security: Without long-running compute, there are no patches or fixes, and each new instance is isolated and fresh by default.

These are just a handful of examples of the ways we want to best leverage Google Cloud services to simplify how we manage our tech stack, as well as continue to bolster security, scalability, and performance. There are many other ideas we’re exploring: using Dataproc and Datastream to support the specific data needs of Islamic banking, Cloud Functions so that customers can run their own queries against Mambu, and AI-enabled features.

At Mambu, our mission is to empower our customers to deliver great modern financial experiences easily to everyone around the world. Every time Google Cloud opens a new data center, we can enter a new market. Every time we move to a new-to-us managed service via the Google Cloud Marketplace, we free up time to build new ways to deliver customer-centric banking solutions. And so, we look forward to continuing this partnership with Google Cloud well into the future.